Additionally, QuickBooks Essentials will send reminders regarding upcoming bills to be paid so that you don’t miss a payment. QuickBooks offers six accounting products, but one of its online accounting plans will be the best choice for most small businesses. Freelancers and independent contractors may opt for simpler options, while larger small businesses might turn to QuickBooks products with advanced inventory, sales and reporting features. Its highest-tiered plan is the Advanced option, which costs $100 per month for the first three months, then $200 per month after that.

- However, customer service isn’t 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options.

- QuickBooks Desktop is an annual subscription, starting at $549.99 per year, which may be cost-prohibitive for small businesses or cash-strapped startups.

- QuickBooks offers a range of integrations covering areas including sales, compliance, marketing, and cash flow forecasting.

- QuickBooks Online’s solid set of features (invoicing, inventory management, reporting, etc.) makes it a great solution for a variety of small businesses.

- But there are some features that many businesses will never need, and the high price tag for QuickBooks Professional may be a reason to look elsewhere.

QuickBooks Desktop Pro Plus: Best For Medium Businesses

See how you can track and manage your whole financial picture in one place—from bank transactions, expenses, and beyond. QuickBooks gives us real-time insight into our business operations and I appreciate that as it allows us to be more productive. Larger businesses with sophisticated inventory, reporting and accounting needs. The majority of small businesses use QuickBooks Online over the other versions of QuickBooks. Larger businesses will be looking at QuickBooks Premier, QuickBooks Enterprise, or the new QuickBooks Online Advanced plan, depending on the number of users they need.

Software that keeps you in control

She is a big fan of working mobile and has been recognized by Intuit as being an expert on QuickBooks Online, having written Intuit’s original courses for the U.S., Singapore and Canadian versions. You can easily scan and upload receipts in real-time using QuickBooks mobile app, so you don’t need to run helter-skelter to collect them at the time of taxes. If you want, you can also invite them to view the reports themselves and download whatever they need. To help determine which of these two widely used financial management tools is best for you, we conducted a comprehensive review process of both. QuickBooks is available for purchase for a fixed fee, while Quicken’s pricing is available for a multitiered variety of monthly and yearly subscription plans.

QuickBooks Online Basics: At a Glance

We believe everyone should be able to make financial decisions with confidence. Those who want to take their accounting on the go will appreciate the mobile app. It brings most of the features of the online platform, plus it enables mileage tracking and receipt capture for quick and convenient recordkeeping.

Intuit’s Lacerte and ProConnect Tax Online tax preparation software for professional accountants who prepare tax returns for a living integrates with QuickBooks in this way. Advanced Pricing / Control , customize, and automate pricing is included in the Platinum and Diamond subscriptions only. One of the best things about QuickBooks is its user-friendly taxability of employer-provided lodging interface. All QuickBooks Online products have the same interface, and so do all the QuickBooks Desktop products. There are also available free online training resources that you can use to get up to speed quickly. All QuickBooks Online plans come with a 30-day free trial—or you can sign up right away and receive a 50% discount for three months.

The Complete Guide To Getting A Free Square Card Reader For Your Business

Few accounting software programs are as fully featured as QuickBooks Online, which lets users track expenses, reconcile bank accounts, generate critical financial reports and much more. In terms of features, QuickBooks Enterprise is about as close as you can get to an ERP without making the switch to full-on business management software. In addition to the strong accounting you’d expect with a QuickBooks desktop product, QuickBooks Enterprise provides invoicing, expense tracking, contact management, project management, job costing, and more.

Perhaps you’ve already used some, like Google’s G Suite or Microsoft’s 365, or perhaps you just need to be able to accomplish something that QuickBooks doesn’t support. Whatever the case, the right integration will make your business operations even more streamlined. But with the right accounting or invoicing software for small businesses, filing tax information can be a simple and streamlined process. QuickBooks makes this process even easier thanks to a huge range of integrations and plug-ins you can use, with familiar names such as PayPal, Shopify and MailChimp all present and accounted for. You can track KPIs with in-depth analysis tools, consolidate data from multiple companies into singular reports, and compare different companies, clients, or franchises. You also get access to exclusive premium apps such as LeanLaw, HubSpot, DocuSign, Bill.com, Salesforce, and more.

An expert can guide you through QBO setup and answer questions based on the information you provide; some bookkeeping services may not be included and determined by the expert. For more information about Expert Assisted, refer to the QuickBooks Terms of Service. Additionally, Premier Plus includes industry-specific features https://www.personal-accounting.org/pr-account-payment-definition/ for manufacturers, wholesalers, nonprofits and retailers. QuickBooks’ ability to streamline financial processes and save time is one of its most significant advantages. Automating tasks like invoicing, expense tracking, and payroll management frees up valuable resources that can be directed towards core business activities.

All these apps integrate seamlessly with each other and QuickBooks accounting software, thus building a well-rounded accounting and payments ecosystem for your small and mid-sized business. To manage payroll through QuickBooks Payroll, you’ll need to pay a fee for this add-on service, with plans ranging from $45 to $125 per month, plus an additional $5 to $10 per employee https://www.adprun.net/ per month. FreshBooks is great for self-employed individuals, sole proprietors and independent contractors. It is incredibly user-friendly and easy to navigate, so if you are a sole proprietor looking for basic accounting software, FreshBooks will meet your needs at a relatively low cost. Its basic plan is in line with QuickBooks Simple Start, at $15 per month.

While this isn’t a drawback necessarily, it’s important to keep in mind. Additional users cost extra, and you can only have one to three users, making this an accounting solution for small businesses. QuickBooks Online offers an incredible number of features and automations. The software covers all the accounting bases as well as invoicing, expense tracking, accounts payable, contact management, project management, inventory, budgeting, and more.

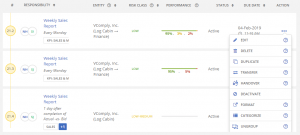

Still, the plan is extremely comprehensive and includes employee expense tracking, batch invoicing and 25 users. Advanced is the only QuickBooks plan to include free 24/7 customer service. Quickbooks Online offers integration with other third-party software and financial services, such as banks, payroll companies, and expense management software. QuickBooks Online is cloud-based software that can be accessed anytime and anywhere from any internet-enabled device and has monthly subscription options. Meanwhile, QuickBooks Desktop is an on-premise software that needs to be installed on the computer where you’ll use it and is available as an annual subscription.

Comments are closed, but trackbacks and pingbacks are open.