Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. It’s full of user guides, help articles and other learning tools so you can hopefully find answers to your questions faster. If you’re running a small business with simple finances, you might be able to handle it all on your own with Xero.

Easy to Use, Stellar Support, It’s a No-Brainer ✔ FreshBooks vs ✘ Xero

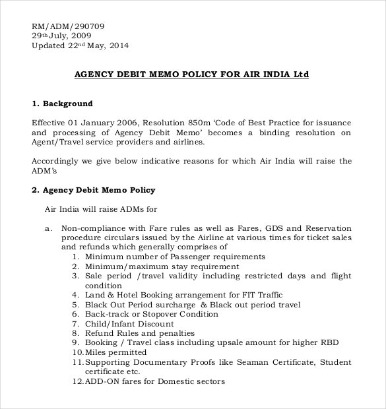

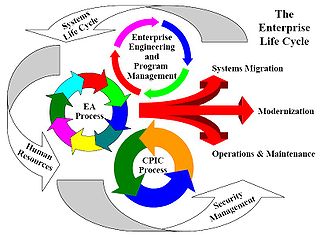

This figure reflects a compound annual growth rate of 10.5 percent across the decade. The following trends are likely to be part of that growth, shaping accounting software as it evolves to meet growing businesses’ needs. With this feature, you can schedule the system to automatically generate and send invoices for recurring charges, such as subscriptions. https://www.online-accounting.net/ You can choose how frequently invoices are sent — daily, weekly, monthly or annually — and indicate whether there’s an end date to the billing. It is possible to purchase cloud access so your team can better collaborate and access the software and its data from anywhere, but costs add up quickly with an additional monthly charge per user.

Xero vs. FreshBooks: Key basic plan features

It also has excellent reporting features and a capable mobile app as well as a customizable dashboard that lets each user rearrange or hide panels according to their preferences. Some have to track inventory, payroll, benefits packages, numerous points of overhead, subcontractors, partnership deals — and so on and so forth. Some, however, just need an easy, reliable way to track the work they do, the invoices they send and the payments they receive, and this is where FreshBooks comes in. It’s easy to learn, easy to use and more affordable compared to many of its competitors. This ensures that businesses are matched with accountants that suit their specific needs. Don’t let the amount of data tied up in your current accounting software stop you from finding the right fit for you and your business.

Invoicing And Payments

95% of users agree that FreshBooks makes it easy to work with your accountant. Xero’ business model is to get people ‘hooked’ and slowly up the price. Sometimes even charging for things that were already part of the product and calling it an add on feature. Stay updated on the latest products and services anytime anywhere. Xero isn’t simply more affordable than either FreshBooks or QuickBooks Online.

Like most accounting programs, FreshBooks’ expense tracking automatically syncs expenses to your FreshBooks account and helps categorize expenses by tax category. Xero is a strange outlier in that it doesn’t include basic expense tracking with every plan—instead, expense tracking only comes with Xero’s priciest plan, which starts at $62 a month. Well, FreshBooks’ fantastic invoicing capabilities make it one of our favorite accounting software for service-based freelancers. If you frequently collaborate on finances with your business’s co-owners, Xero saves you more money than just about any other accounting service provider. ReportingWhen it comes to reporting, QuickBooks lets you drill deeper with transaction tracking tags that you can use to separate results by job type or event, for example. The Plus and Advanced plans go a step further with class and location tags that you can use to see how different areas of your business are doing.

Get the Reddit app

Alright, now that we know the costs, let’s look at why you might want to think about other options besides QuickBooks. This has been discussed ad nauseam, but if anyone has experience relevant to my use case/a link to another thread I’d appreciate it. 95+ years of combined experience covering small business and what is a cost variance personal finance. Finally, Zoho is built intentionally to make work easier for distributed teams. Zoho itself operates via a decentralized workforce, and its tools are designed with this paradigm in mind. It’s user-friendly, flexible and affordable, especially in comparison to more enterprise-grade solutions.

The interface is clean and straightforward, making it easy to find what you’re looking for. If your company is small and scaling and your accounting team does not require advanced features, FreshBooks is an attractive option. Its price is very competitive and the platform has excellent features. Xero offers BI, reports and visualizations via different hubs, dashboards and features. They can also track projects, manage contacts, use the Xero Hubdoc and file storage hub, or through reporting, inventory, sales and other features. Talk to your accountant and start a free trial to see how easy it is to work together.

And whenever a brand has that kind of preeminence, it’s often difficult to remember that there are alternatives or that the incumbent isn’t always the best option. There are major limitations when attempting to modify data within the software or correct recording errors. They advertise that any business owner can do everything themselves with the software, but in practice, most of the things business owners do are inaccurate. The chatbot also doesn’t function properly 100% of the time, which adds to the frustration. When calling the hotline…It takes a long time, and when a human finally answers, they don’t have the decision-making autonomy to help. This feature allows you to set up an approval process for your invoices.

For instance, since Xero only includes project tracking with its most expensive plan, it’s a better pick for product-based freelancers and businesses than for service-based business owners. It also lacks multicurrency support for all but its most expensive plan. So if you’re selling products outside of the United States, FreshBooks or Zoho (which do have multicurrency support) will make your life a little easier. Inventory managementIf you manage a small amount of inventory and need basic tracking functions, FreshBooks can get the job done. QuickBooks goes beyond basic inventory tracking, with reorder points and the ability to purchase inventory directly from within the platform. You also can set pricing rules to customize rates, and run inventory reports to find out which products are your best sellers and which carry the highest cost.

You can easily test out expense tracking and importing during your 30-day free trial. When setting up a FreshBooks account, you can start fresh, or transfer over existing data from any previous software like QuickBooks, HoneyBook QuickBooks Online, Zoho Books, or Xero. For Taxes, you can email us the below details, and we’ll take care of it for you. Instead of wasting time labouring over manual inputs or struggling to keep track of bulky receipts, you can use the FreshBooks accounting application to safely automate your accounting.

You can enjoy project conversations, file sharing and project due dates, but these features are most helpful for individual or small-team projects. FreshBooks and Xero are both powerful accounting tools that can help businesses keep their financial information and assets organized and accessible. But the two apps are geared toward different audiences, which explains https://www.business-accounting.net/cloud-accounting-best-accounting-software-for/ their functional differences. Another area where QuickBooks shines is its workflows feature, enabling you to schedule reminders and automate tasks. For example, you can tell QuickBooks to automatically generate and send reports to people via email on a specific schedule. You can either choose from several templated workflows or create your own from scratch.

Xero also integrates with other business applications, such as payroll and inventory management systems. This makes it a versatile tool for small businesses that need to streamline their operations. To choose our list of the best accounting software, our small business experts spent hours researching and testing some of the most popular solutions on the market. We started by examining subscription prices, plans and fees to determine which platforms offered the most value for the money. Then, we got to work testing some of the most important features, like invoicing tools, accounts payable and receivable management, payment reminders, support for contractors and financial reporting. We also looked for platforms that were customizable, enabling users to adjust dashboards to present the most important information at a glance.

With Xero, all plans include a bank reconciliation tool that suggests transaction matches for you, making it easy to reconcile bank accounts. If a bank statement line meets the set of criteria you specified, Xero will suggest creating a matching transaction for you. Additionally, Xero’s customizable dashboard and global search function make the software easy to navigate.

We looked at a wide range of data quality solutions to compile this list of the best software. We assessed different parameters for each software, including its usability, scalability, standout features and customer support. We also considered customer testimonials and ratings as vital components of our overall assessment of each software. Zoho is one of the very few financial solutions with a completely free tier. A number of core features are limited with the free version, but it’s effectively an infinite demo, and teams that find they need a bit more oomph can upgrade at any time.

- Everything starts from the dashboards of FreshBooks and QuickBooks.

- Both FreshBooks and QuickBooks are popular accounting software programs because they meet the needs of a wide range of clients.

- If you send dozens of invoices a month to dozens of clients, accounting software with truly unlimited invoicing will be a better fit for you than either Xero or FreshBooks.

- If you’re in the market for a more premier solution but still want something other than QuickBooks, there is at least one other name that has as much history as Intuit’s flagship product.

- With FreshBooks, you can rest easy knowing that your accounting struggles are behind you.

It’s a plus for accounting software to serve as an invoice generator. Many of the household accounting software names, such as QuickBooks, Xero and Zoho Books, can be classified as integrated accounting software solutions. FreshBooks is very easy to set up, and you can be up and running within minutes. You also don’t need to be an accounting expert to use it, and it integrates seamlessly with most banks in order to import your transactions. Plus, it comes with some great features for freelancers or project-based businesses that charge by the hour.

Comments are closed, but trackbacks and pingbacks are open.